Introducing the block trade functionality

The feature increased efficiency of large-volume transactions for over 5% of users.

Intro

Client

SpectraxeRole

UX/UI designerDuration

Mar 2025 — present timeDue to confidentiality agreements, only certain aspects of the design work can be shared, without revealing specific details about the project.

Goal

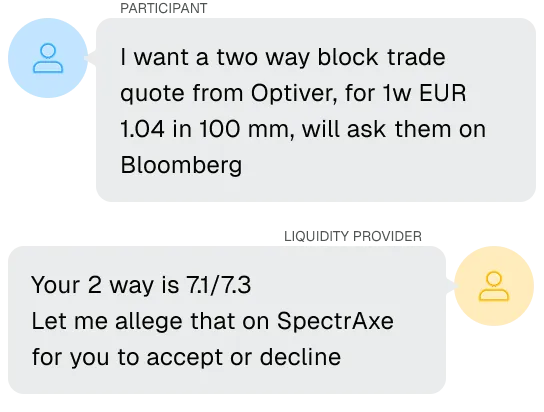

Create a new mechanism for booking and matching — block trades, which provides the ability to liquidity providers to book pre-agreed trades with a known counterparty.

Outcome

I designed a block trading feature that simplifies large-order trading by consolidating it into a single transaction. This allows liquidity providers to efficiently input trade details, verify counterparties, and confirm transactions securely. The first piece of user feedback was, “This was surprisingly easy.”

Process

Problem exploration

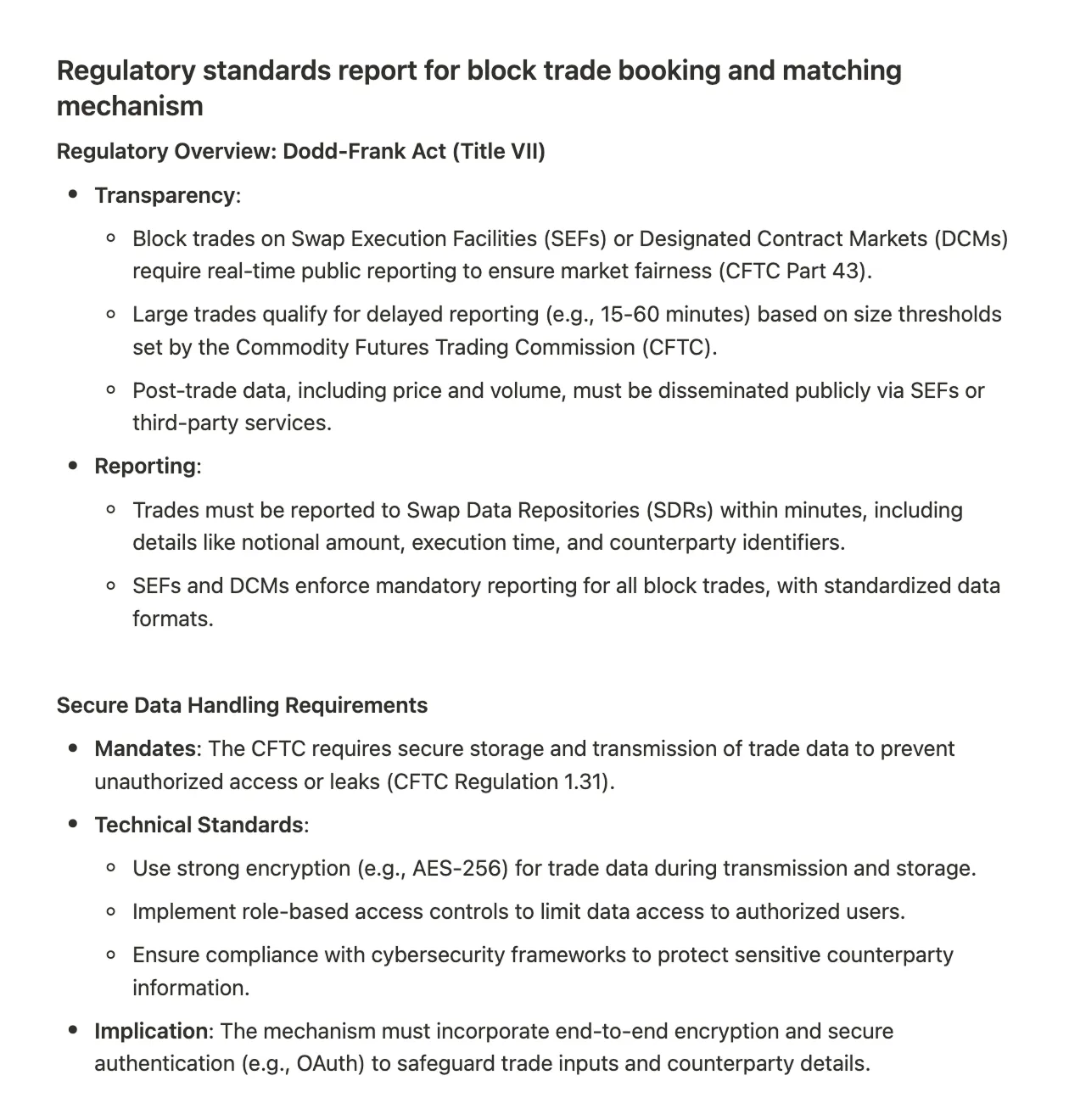

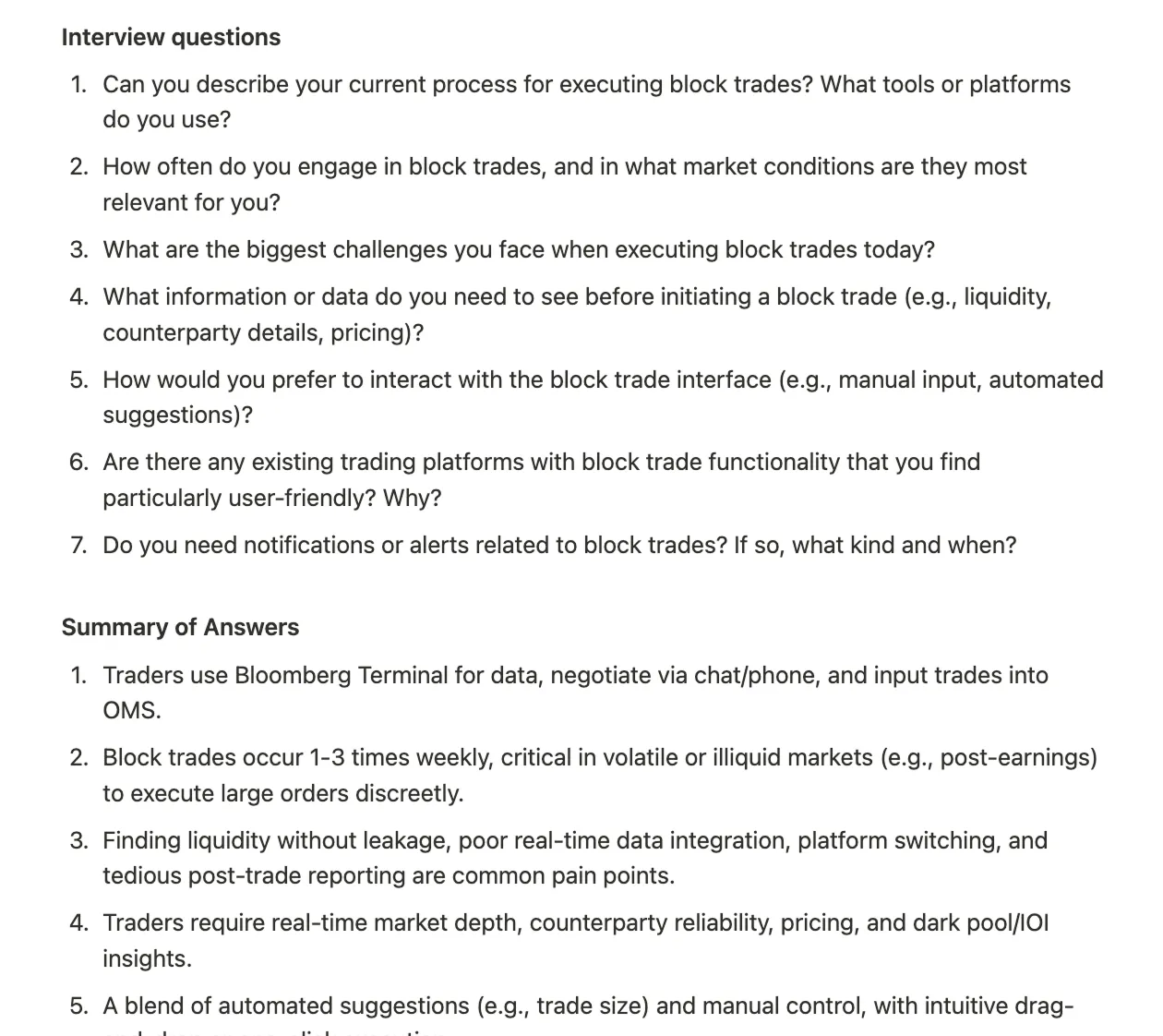

I researched the challenges faced by liquidity providers and traders when executing large orders, using user interviews provided by stakeholders, and compiled a summary of financial regulations impacting block trades.

From my research, I identified regulatory standards and key benefits of block trade functionality for institutional traders:

- Off-exchange execution of large trades reduces price volatility, preserving trade value.

- Aggregated trades lower transaction fees.

- Confidential deal negotiations prevent market sentiment shifts, protecting trader strategies.

Defining requirements

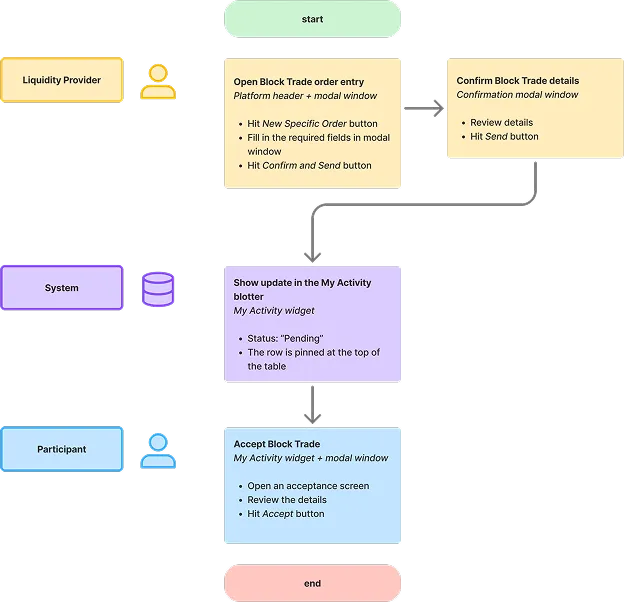

In collaboration with the stakeholders we defined the following successful flow:

Based on insights from the exploration phase and collaboration with the stakeholders, I worked together with business analyst and developers to define clear functional and non-functional requirements.

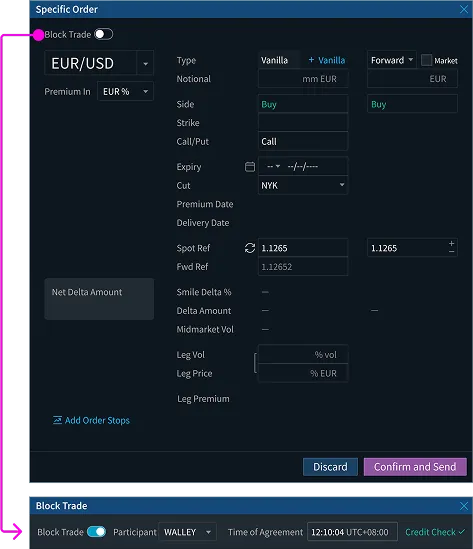

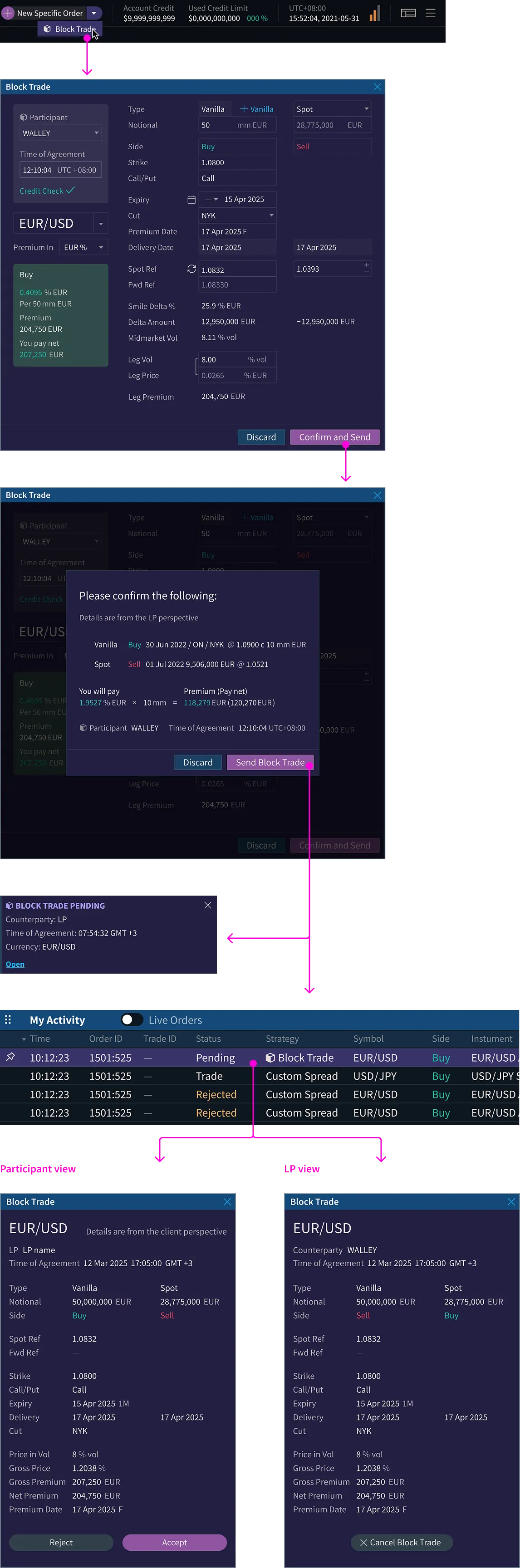

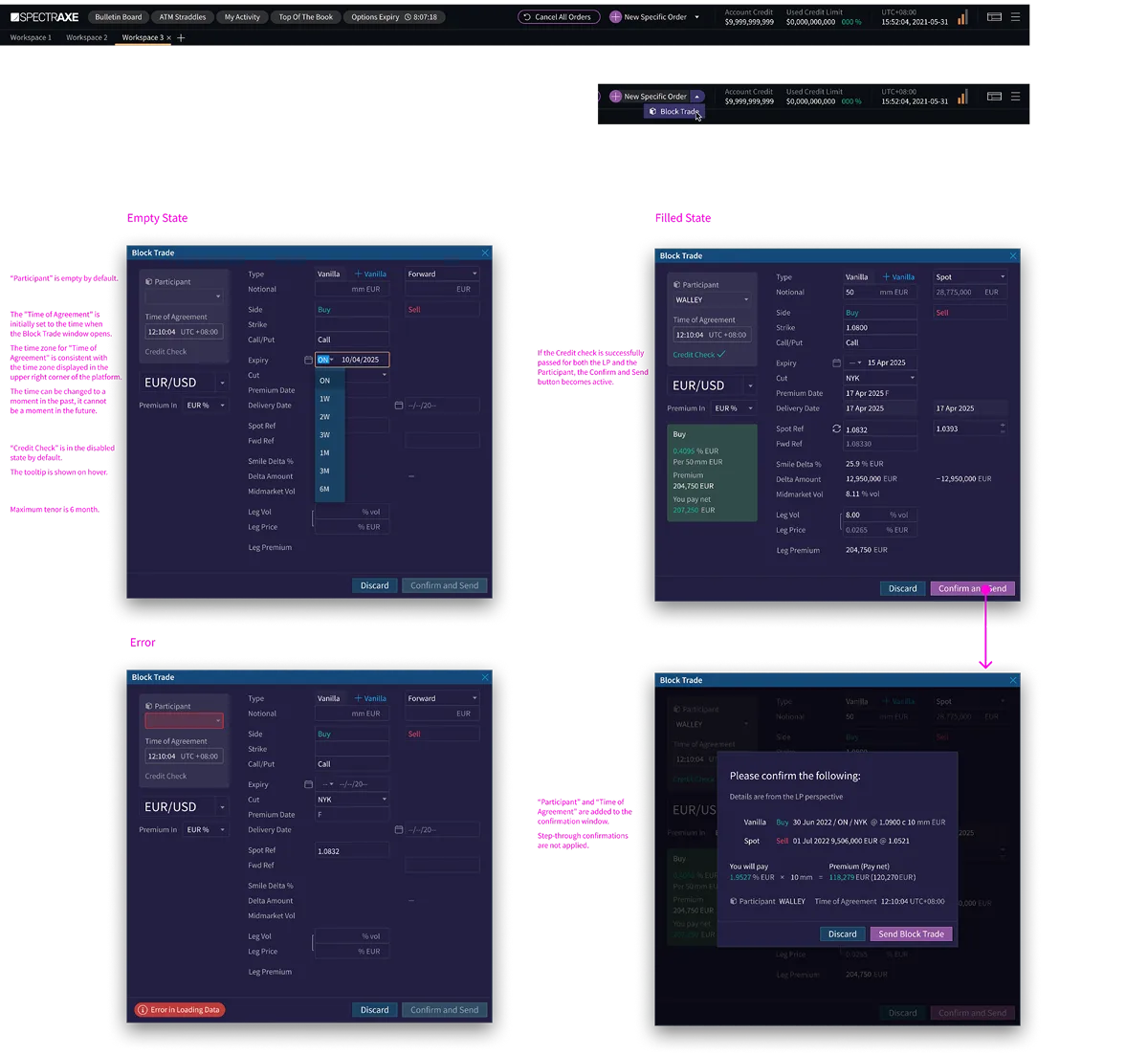

Key requirements included:

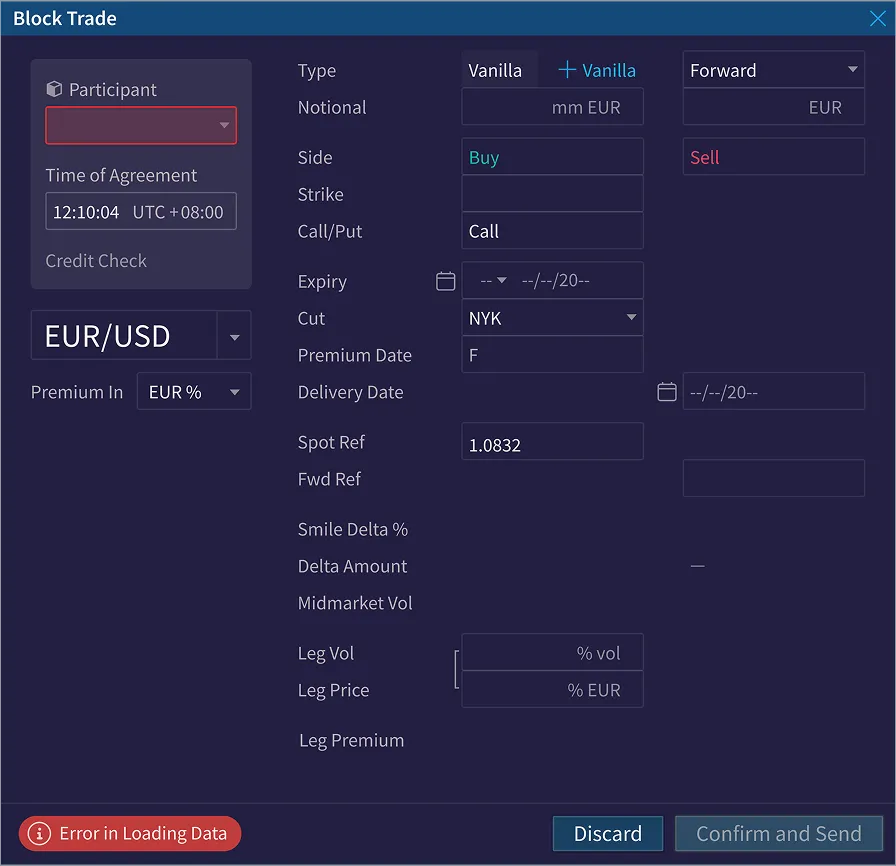

- An order entry window for liquidity providers initiating pre-agreed trades.

- Preview screen for liquidity providers to be able to cancel the trade before it's accepted.

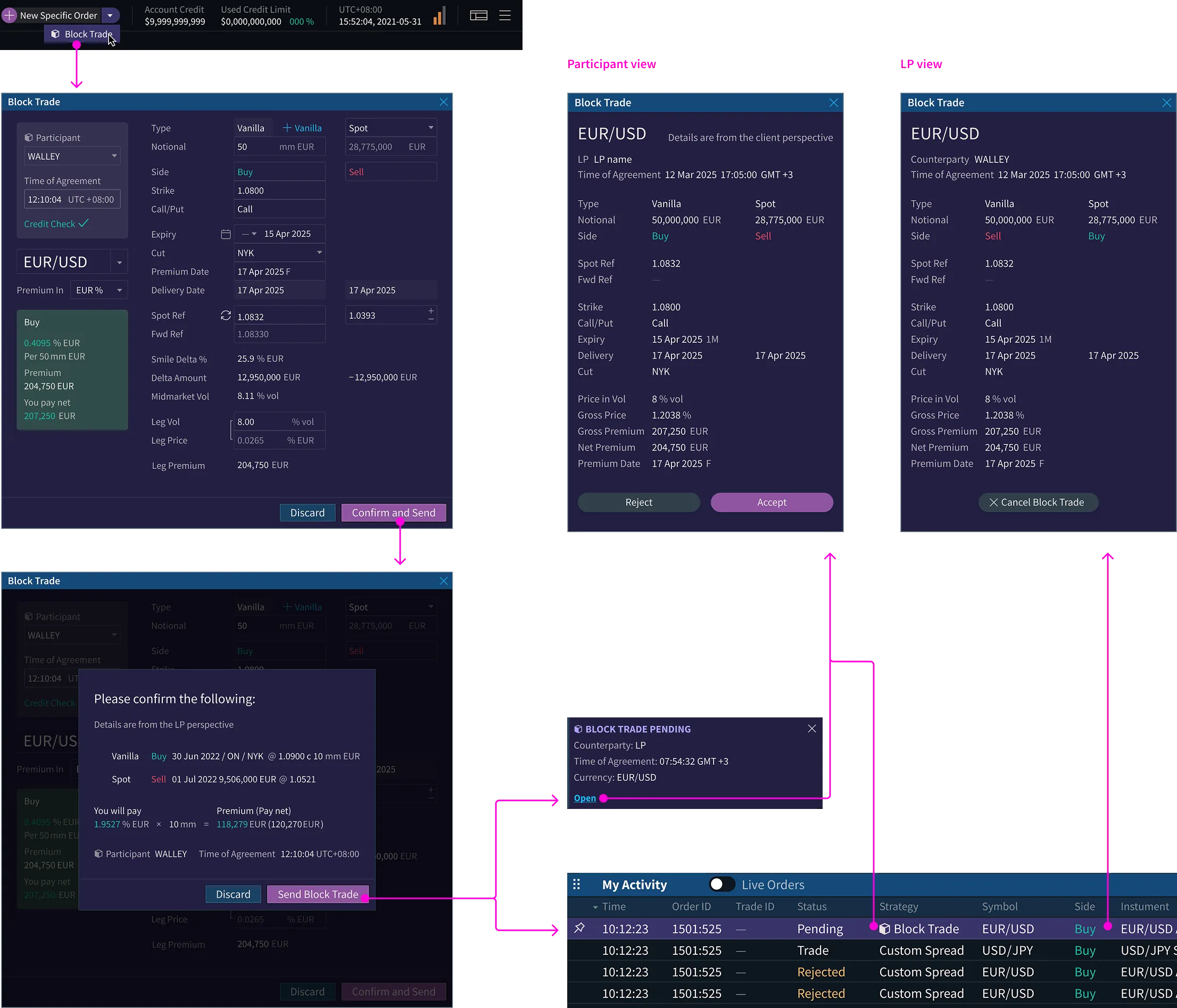

- A user interface for participants for confirming or rejecting pre-agreed trades.

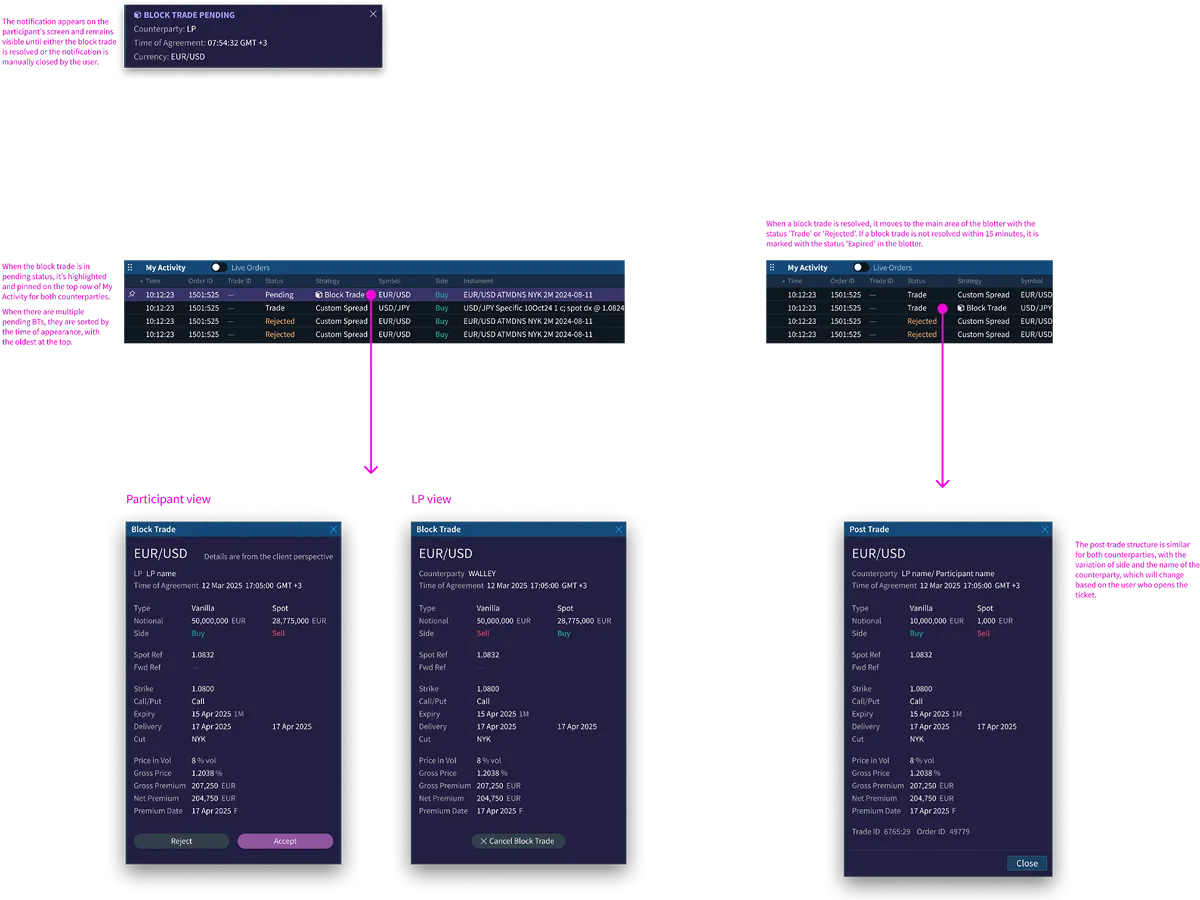

- Notification about the block trade pending.

- The order description with a pending status available in a blotter.

- Post-trade ticket for the both sides of the block trade.

Architecture & wireframing

Next, I designed 2 variants of the system architecture to propose them to the team and stakeholders to select the best option together.

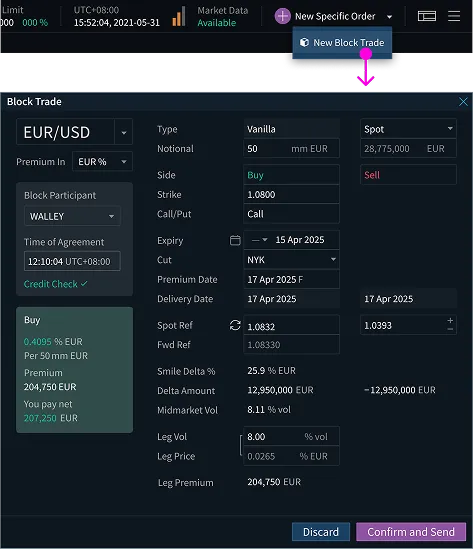

Concepts of the flow's starting points

Option 1:

Separate entry point available for LPs + new

interface for the block trade order entry.

Option 2:

Switch mode in the order entry to do to the block

trade.

We decided to stick with the first option and make the block trade functionality more distinctive from the regular order entry window.

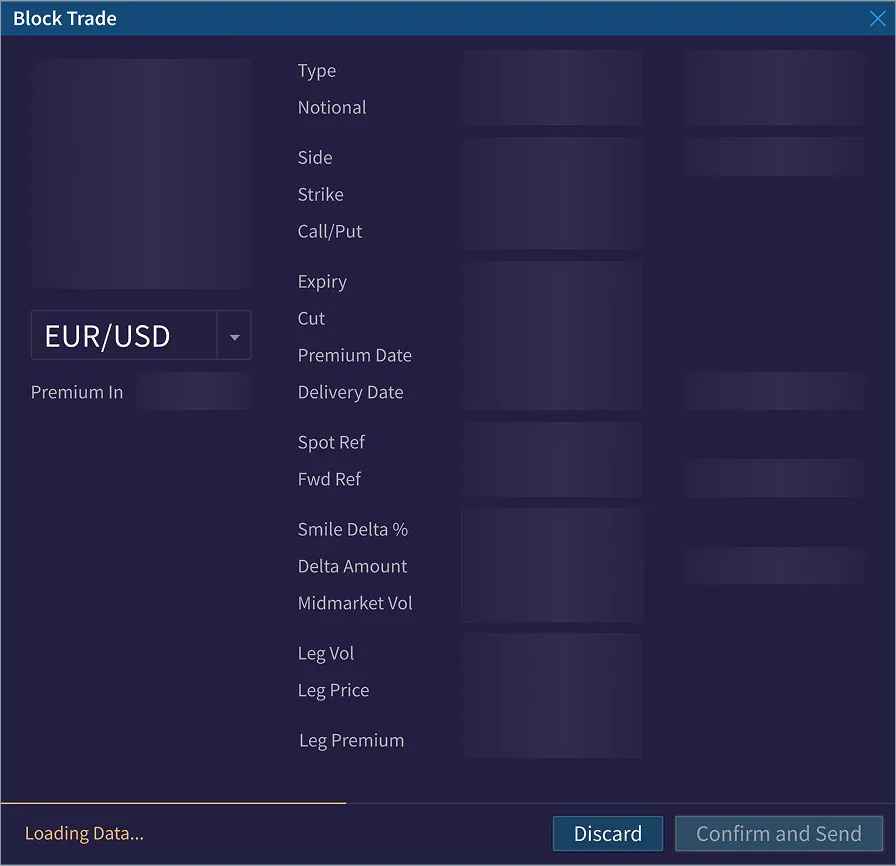

I mapped out the flow ensuring seamless integration with the platform's infrastructure. Using Figma, I created wireframes to visualize the user journey:

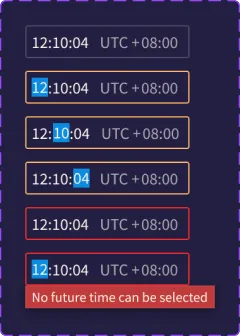

- An order entry for initiating block trades, with fields for the time of agreement and counterparty selection.

- A confirmation screen displaying trade terms.

- An acceptance screen for a participant and a preview screen with ability to cancel for a liquidity provider.

- Notifications for pending block trade.

Iterative feedback sessions with stakeholders refined the wireframes, balancing usability with technical feasibility to create an intuitive experience for traders.

Design documentation

In the final phase, I compiled comprehensive design documentation, including:

- detailed UI mockups,

- interaction flows,

- technical specifications for developers.

The documentation outlined edge cases and error-handling mechanisms to ensure robustness.

User testing with a small group of traders confirmed that the feature reduced complexity and improved trade predictability. Final changes were made based on feedback, ensuring the design met the goal of a clear, reliable block trade experience.

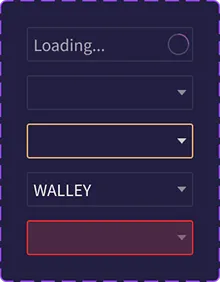

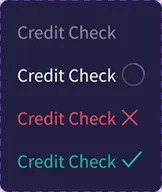

States & details

Outcome

The block trading feature increased efficiency of large-volume transactions for over 5% of users, improved platform liquidity and strengthened competitive positioning in the options trading market.

The feature quickly gained popularity, and users requested support for non-deliverable currency pairs. The design is currently in progress.